Becoming a contractor infographic

If you’ve always been a full-time employee, it’s possible that you’ve never given a second thought to how the financial year runs. If you plan to become self-employed, however, your schedule will change dramatically. The start of the financial year is April 6th, and it’s vital that new contractors familiarise themselves with key tax deadlines and dates.

Your tax obligations will ultimately depend on your circumstances. If you’ve simply registered as a sole trader, you’ll need to submit a self-assessment return by the end of October (for paper-based returns) or by the end of January (if you plan to make your submission online). Paper returns may be just a few years from extinction, as HM Revenue and Customs (HMRC) is increasingly encouraging people to make digital submissions. More than 85% of taxpayers made online submissions in 2014 - 2015.

If you’ve registered as a limited company, you’ll have other responsibilities to take into account. You need to make your corporation tax contributions nine months and one day after your company’s financial year ends, so it’s crucial that you get your dates right. HMRC is very strict when it comes to late or failed payments.

To ensure that your tax affairs are in good order right from the very start, the infographic below can help you get organised. The statistics highlight the fact that more people in the UK are becoming self-employed, and that the number of self-assessment submissions being handled by HMRC each year is on the rise. They also show that despite the threat of financial penalties for late submissions, many self-assessments are left until the very last minute – a risky thing to do. The timeline shows the key dates that sole traders and limited company owners need to follow.

See more Construction industry infographics.

--Quantic UK 10:19, 16 March 2015 (UTC)

Featured articles and news

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.

CIOB Client Guide (2nd edition) March 2025

Free download covering statutory dutyholder roles under the Building Safety Act and much more.

AI and automation in 3D modelling and spatial design

Can almost half of design development tasks be automated?

Minister quizzed, as responsibility transfers to MHCLG and BSR publishes new building control guidance.

UK environmental regulations reform 2025

Amid wider new approaches to ensure regulators and regulation support growth.

The maintenance challenge of tenements.

BSRIA Statutory Compliance Inspection Checklist

BG80/2025 now significantly updated to include requirements related to important changes in legislation.

Shortlist for the 2025 Roofscape Design Awards

Talent and innovation showcase announcement from the trussed rafter industry.

OpenUSD possibilities: Look before you leap

Being ready for the OpenUSD solutions set to transform architecture and design.

Global Asbestos Awareness Week 2025

Highlighting the continuing threat to trades persons.

Retrofit of Buildings, a CIOB Technical Publication

Now available in Arabic and Chinese aswell as English.

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

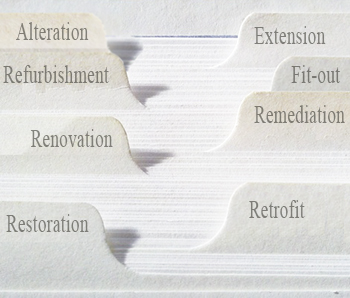

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.